Allocation: $1,423,000,000

This program will provide gap funding, for properties being developed with low income tax credits.

CDBG-DR GAP TO LOW INCOME HOUSING TAX CREDITS PROGRAM

The substantial reduction in available housing units combined with a surge of displaced residents in need of housing, represents a major hindrance to long-term recovery. Incentives are required to spur development and replenish the current inventory of new or rehabilitated, resilient, and affordable rental housing.

The low-income housing tax credit (LIHTC) program is the federal government’s primary policy tool for encouraging the development and rehabilitation of affordable rental housing. The program awards developers federal tax credits to offset construction costs in exchange for agreeing to reserve a certain fraction of units that are rent-restricted for lower-income households. The credits are claimed over a 10-year period. Developers need upfront financing to complete construction so they will usually sell their tax credits to outside investors (mostly financial institutions) in exchange for equity financing. The equity reduces the financing developers would otherwise have to secure and allows tax credit properties to offer more affordable rents.

The CDBG-DR Gap to Low-Income Housing Tax Credits Program (the Program), as approved in the Puerto Rico Disaster Recovery Action Plan (Action Plan), as amended, will provide the incentive required to spur development, and replenish the current inventory of new or rehabilitated, resilient, and affordable rental housing.

Effective utilization of the Low-Income Housing Tax Credits (LIHTC) Program combined with Community Development Block Grant-Disaster Recovery (CDBG-DR) funding will maximize said incentive.

GUIDELINES

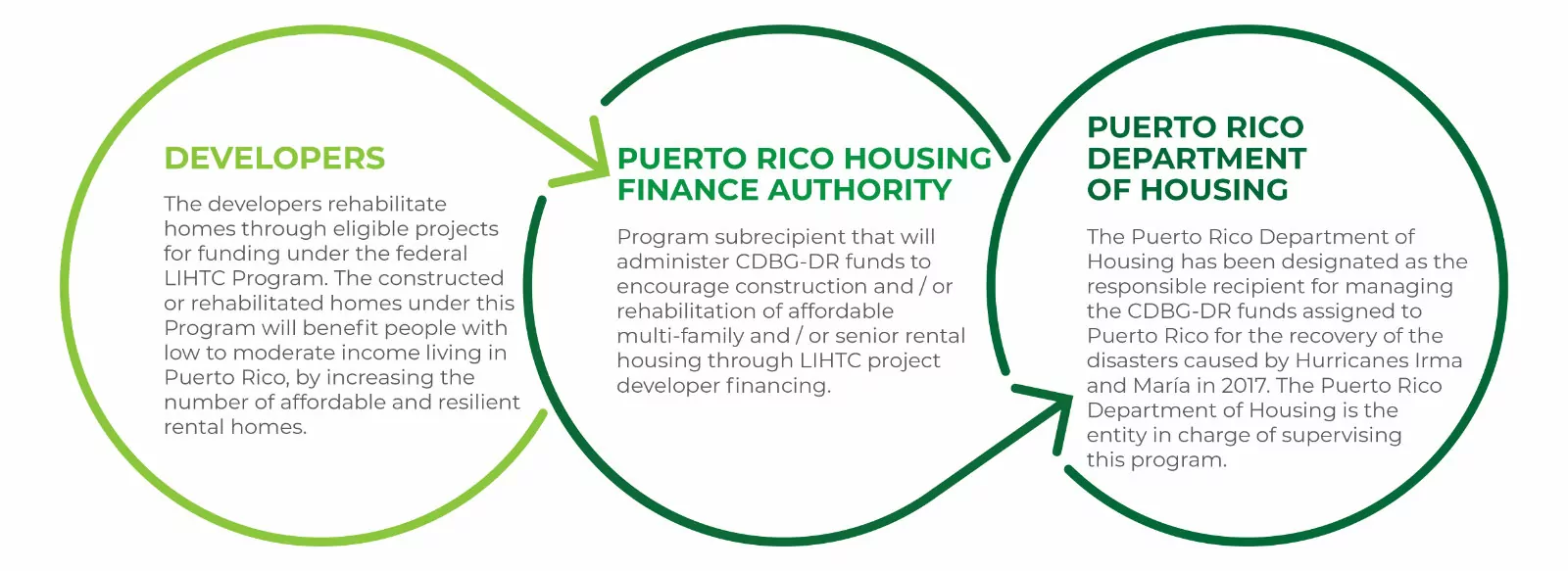

Image A1 information

Developers: The developers rehabilitate homes through eligible projects for funding under the federal LIHTC Program. The constructed or rehabilitated homes under this Program will benefit people with low to moderate income living in Puerto Rico, by increasing the number of affordable end resilient rental homes.

Puerto Rico Housing Finance Authority: Program subrecipient that will administer CDBG-DR funds to encourage construction of affordable multi-family and / or senior rental housing through LIHTC project developer financing.

Puerto Rico Department of Housing: The Puerto Rico Department of Housing has been designated as the responsible recipient for managing the CDBG-DR funds assigned to Puerto Rico recovery of the disasters caused by Hurricanes Irma and María in 2017. The Puerto Rico Department of Housing is the entity in charge of supervising this program.

The Puerto Rico Housing Financing Authority (PRHFA) has been designated as the managing entity of the Program and, consequently, will administer the CDBG-DR funds assigned to it under the supervision and with the collaboration of the Puerto Rico Department of Housing. The allocated funds for the LIHTC CDBG-DR Gap Program is $1,423,000,000.

There are two types of tax credits for the acquisition, rehabilitation, or construction of rental housing for low-income households.

9%: Available for the construction or renovations that are not financed with tax-exempt bonds.

PHASE 1 | 9% Tax Credits

For the implementation of the first phase of the program, the Department of Housing and PRHFA provided economic assistance through CDBG-DR funds to projects that, according to the financing cycle of the 2016 ‘Qualified Allocation Plan’ (QAP), were ready to go with the nine percent (9%) of LIHTC.

4%: Available for existing homes, construction, or renovations financed with tax-exempts bonds.

PHASE 2 | 4% Tax Credits

In September 2020, the Department of Housing and PRHFA announced a new project cycle for LIHTC under the four percent (4%) in accordance with the financing cycle of the 2020 ‘Qualified Allocation Plan’ (QAP). In this second phase, $1.8 billion of CDBG-DR funds, in conjunction with LIHTC and other types of funding, will be used to maximize the resources to create projects that meet multiple objectives.

PRHFA is currently evaluating the proposals that were submitted for the projects during this second phase of the Program, which closed in November 2020.

SUMMARY OF THE ELIGIBILITY AND APPLICATION PROCESS

The selection criteria and other important aspects can be found in the Qualified Allocation Plan (QAP). The Puerto Rico Housing Finance Authority (PRHFA) will allocate CDBG-DR funds (grants and/or loans) to fill any existing financial gaps. Prior to being awarded CDBG-DR funding the following must be completed and submitted for each eligible project:

- PRHFA Threshold Review

- PRHFA Ranking Evaluation

- PRHFA Technical Feasibility Study and Cost Evaluation

- Initial PRHFA Underwriting Analysis and Subsidy Layering Review; and

- PRDOH Environmental Review

The Qualified Allocation Plan published at https://www.afv.pr.gov should be used in conjunction with the Program Guidelines as reference for detailed responsibilities and compliance requirements.

ASSISTANCE

The Program’s objective is to leverage LIHTC to amplify the impact of CDBG-DR funding with the aim of increasing the inventory of affordable multifamily and elderly rental units. To accomplish this, the Puerto Rico Department of Housing (PRDOH) intends to optimize the use of CDBG-DR funds by providing gap funding, by means of either a grant or loan, to leverage available LIHTCs to develop or rehabilitate affordable rental housing. All developments funded through this Program will primarily benefit low- and moderate income (LMI) populations.

The CDBG-DR funding reservation will be based upon the threshold review, point ranking evaluation, environmental review, technical and financial feasibility reviews, and any other applicable factors as determined by PRHFA and PRDOH.

In addition, CDBG-DR funds will be set-aside for either the preservation, rehabilitation, or new construction of multifamily housing projects. These projects are part of the comprehensive plan to redevelop, replace, and rehabilitate existing or former Puerto Rico Public Housing Administration’s (PRPHA) inventory as depicted in the CDBG-DR Action Plan.

Homes built or rehabilitated under this Program could benefit any resident of Puerto Rico with low to moderate income, by increasing the inventory of affordable and resilient rental homes in the Island. Similarly, legally established developers, individuals or entities that provide rental housing can benefit.

TRANSPARENCY PORTAL

Learn more about the progress of this program on the Transparency Portal

This portal is automatically updated on a daily basis.